Have you ever considered the deep-seated emotions and psychology driving your financial decisions? In my latest read, “The Psychology of Money” by Morgan Housel, I’ve unearthed some groundbreaking insights that reshaped my understanding of money, success, and the risks we often unknowingly take. Here’s why this book is a must-read and how it can transform your approach to wealth and happiness.

The Number One Financial Risk: Chasing What We Don’t Need

One pivotal realization from Housel’s work is understanding the gravest financial risk: risking what we have for what we don’t need. Reflecting on notorious financial downfalls – from Enron to Bernie Madoff – it’s startling to see how often unnecessary risks are at the core of these disasters. These stories are not just about greed or ambition; they’re about the all-too-human tendency to jeopardize what we have in pursuit of what we think we need for status, validation, or fulfillment.

The Emotional Labyrinth of Money

Money isn’t just a currency; it’s an emotional and psychological entity. We often make decisions based on how money makes us feel or how we believe it will make others perceive us. This emotional processing can lead to choices that, logically, we know aren’t right. How many times have we bought something believing it would elevate our status or happiness, only to be left with regret and anxiety?

The Mirage of Money Buying Happiness

We’ve all heard that money can’t buy happiness, but do we truly believe it? Our careers, lifestyles, and even the education paths we choose are often heavily influenced by potential financial outcomes. Yet, time and again, we find that financial success doesn’t equate to contentment. Instead, it can lead to a lack of genuine relationships, diminished health, and a constant chase for more.

Warren Buffett’s Wisdom: Patience Over Profit

Warren Buffett’s approach to investing – prioritizing long-term gains and peace of mind over immediate profits – is a lesson in patience and understanding the real value of money. He famously said he wouldn’t risk losing a night’s sleep for additional profits. This philosophy underscores the importance of valuing our health, family, faith, and freedom above financial gains.

Embracing a Healthy Relationship with Money

Understanding and redefining our relationship with money is crucial. It’s not just about making smart investment choices; it’s about recognizing the emotional undercurrents that drive our financial decisions. This awareness can lead to more fulfilling life choices that align with our true values and happiness.

“The Psychology of Money” isn’t just a guide to managing finances; it’s a mirror reflecting our complex, often irrational relationship with money. I highly recommend this enlightening read to anyone looking to unravel the emotional threads tied to their financial decisions.

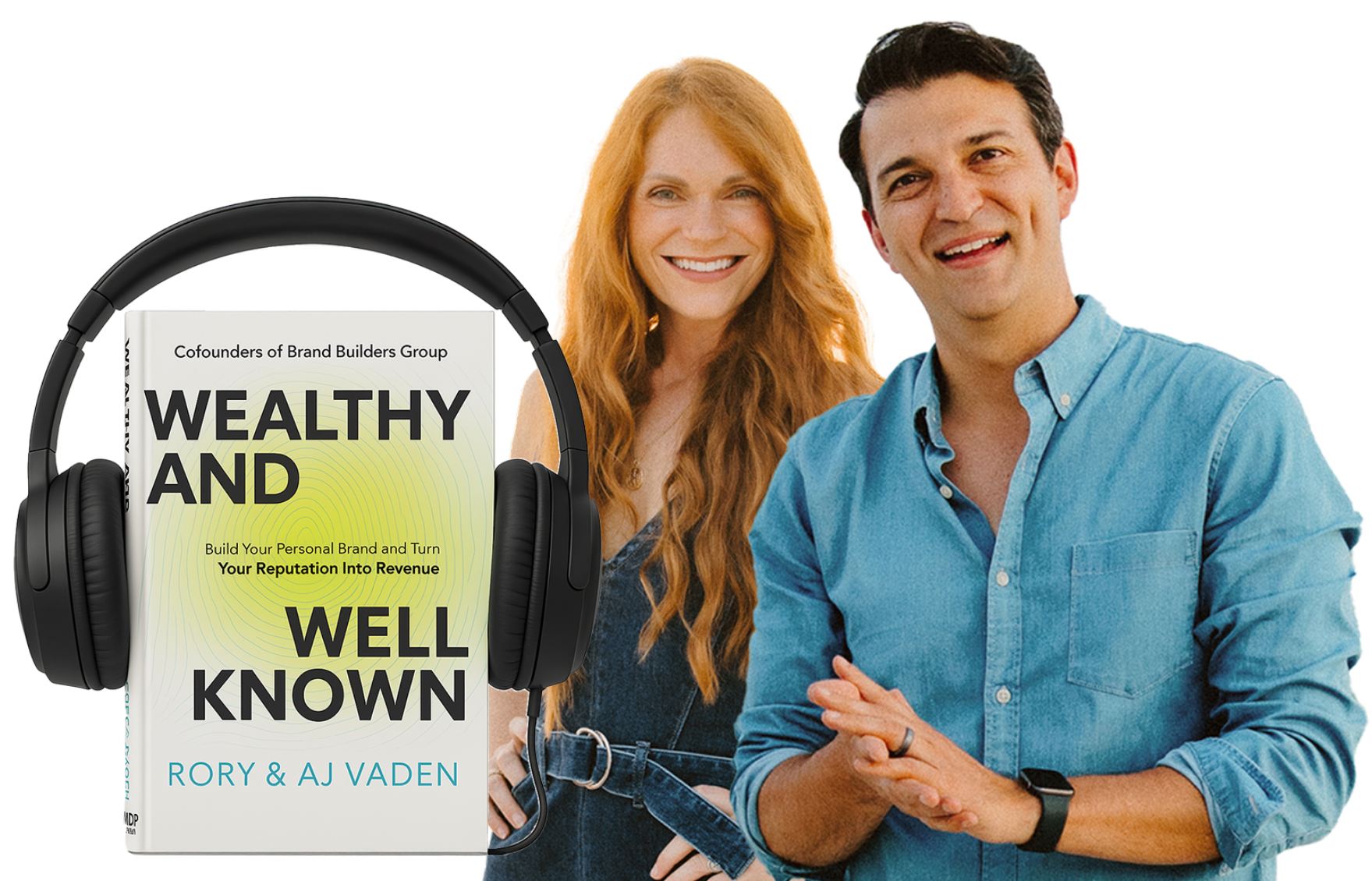

Remember, scheduling a Free Brand Call with Brand Builders Group can be a step towards aligning your personal brand with your financial goals and values. It’s about creating a brand that reflects who you are and what truly matters to you.